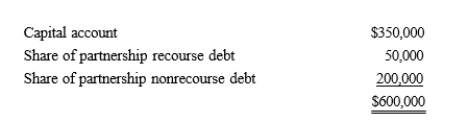

The MOP Partnership is involved in construction activities.On January 1 of the current year, Patricia has an adjusted basis of $600,000 for her partnership interest consisting of the following.  During the year, the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia.Partnership liabilities were the same at the end of the tax year, and the nonrecourse debt is not qualified nonrecourse debt.If she owns a 60% share of partnership profits, capital, and losses, and is an active (material) participant in the partnership, how much of her share of the operating loss can Patricia deduct? (Assume that Patricia is a single taxpayer and has no business losses from other sources.) What Code provisions could cause a suspension of the loss? How would your answer change if MOP were an LLC and Patricia had not personally guaranteed any of the debt?

During the year, the partnership has an operating loss of $1.2 million and distributes $60,000 of cash to Patricia.Partnership liabilities were the same at the end of the tax year, and the nonrecourse debt is not qualified nonrecourse debt.If she owns a 60% share of partnership profits, capital, and losses, and is an active (material) participant in the partnership, how much of her share of the operating loss can Patricia deduct? (Assume that Patricia is a single taxpayer and has no business losses from other sources.) What Code provisions could cause a suspension of the loss? How would your answer change if MOP were an LLC and Patricia had not personally guaranteed any of the debt?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q126: Palmer contributes property with a fair market

Q181: Match each of the following statements with

Q183: Sarah contributed fully depreciated ($0 basis) property

Q184: Match each of the following statements with

Q185: Katherine invested $80,000 this year to purchase

Q189: Match each of the following statements with

Q193: Match each of the following statements with

Q200: During the current year, MAC Partnership reported

Q205: In the current year, Derek formed an

Q221: On the formation of a partnership, when

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents