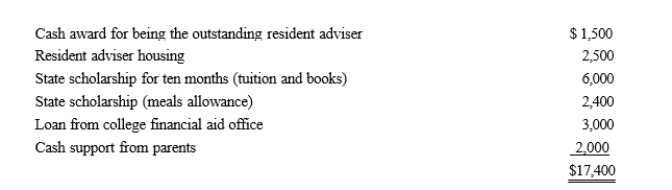

Ron, age 19, is a full-time graduate student at City University.During 2019, he received the following payments:  Ron served as a resident adviser in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2019?

Ron served as a resident adviser in a dormitory and, therefore, the university waived the $2,500 charge for the room he occupied.What is Ron's adjusted gross income for 2019?

A) $1,500.

B) $3,900.

C) $9,000.

D) $15,400.

E) None of these.

Correct Answer:

Verified

Q35: For purposes of computing the credit for

Q37: A taxpayer's earned income credit may be

Q45: Jena is a full-time undergraduate student at

Q51: A scholarship recipient at State University may

Q57: During the current year, Khalid was in

Q60: Barney is a full-time graduate student at

Q77: Which of the following is not a

Q87: The alimony recapture rules are intended to:

A)Assist

Q98: The alimony rules applicable to divorces entered

Q99: Under the terms of a divorce agreement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents