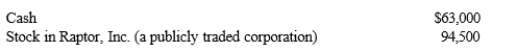

During the current year, Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor as an investment 14 months ago at a cost of $42,000.Ralph's AGI for the year is $189,000.What is his charitable contribution deduction for the current year?

Ralph acquired the stock in Raptor as an investment 14 months ago at a cost of $42,000.Ralph's AGI for the year is $189,000.What is his charitable contribution deduction for the current year?

A) $56,700

B) $63,000

C) $94,500

D) $157,500

E) None of these

Correct Answer:

Verified

Q43: Roger is considering making a $6,000 investment

Q49: Jack received a court award in a

Q54: Ahmad is considering making a $10,000 investment

Q62: Pat gave 5,000 shares of stock in

Q73: Kevin and Shuang have two children, ages

Q74: Which of the following, if any, correctly

Q76: In 2019, George and Martha are married

Q120: Hugh, a self-employed individual, paid the following

Q121: Paul, a calendar year single taxpayer, has

Q128: Harry and Wei are married and file

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents