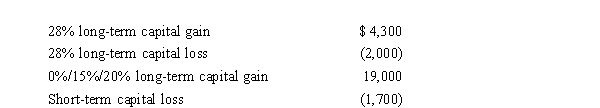

Harold is a head of household, has $27,000 of taxable income in 2019 from noncapital gain or loss sources, and has the following capital gains and losses:  What is Harold's taxable income and the tax on that taxable income (ignore the standard deduction)?

What is Harold's taxable income and the tax on that taxable income (ignore the standard deduction)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: Which of the following statements is correct?

A)When

Q46: Which of the following would extinguish the

Q51: A retail building used in the business

Q71: On January 10, 2019, Wally sold an

Q73: Willie is the owner of vacant land

Q75: Sharon has the following results of netting

Q76: Larry was the holder of a patent

Q77: On January 18, 2018, Martha purchased 200

Q78: Phil's father who died on January 10,

Q104: The following chart details Sheen's 2017, 2018,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents