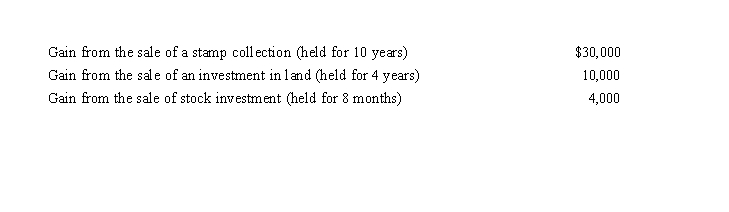

Perry, a single taxpayer, has taxable income of $178,000 and is in the 32% tax bracket.During 2019, he had the following capital asset transactions:  Perry's tax consequences from these gains are as follows:

Perry's tax consequences from these gains are as follows:

A) (15% × $30,000) + (32% × $4,000) .

B) (15% × $10,000) + (28% × $30,000) + (32% × $4,000) .

C) (0% × $10,000) + (28% × $30,000) + (32% × $4,000) .

D) (15% × $40,000) + (32% × $4,000) .

E) None of these.

Correct Answer:

Verified

Q39: Carin, a widow, elected to receive the

Q70: Heather's interest and gains on investments for

Q76: During 2019, Trevor has the following capital

Q83: In December 2019, Todd, a cash basis

Q88: Harold bought land from Jewel for $150,000.Harold

Q89: On January 1, 2009, Cardinal Corporation issued

Q89: On January 1, Father (Dave) loaned Daughter

Q93: The purpose of the tax rules that

Q93: Flora Company owed $95,000, a debt incurred

Q99: Emily is in the 35% marginal tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents