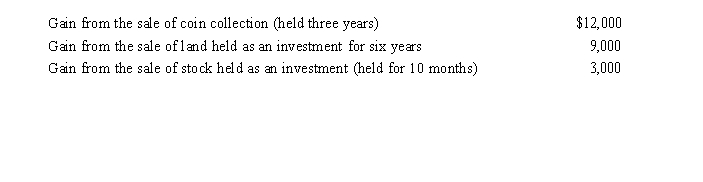

During 2019, Jackson, a single taxpayer, had the following capital gains and losses:

a.How much is Jackson's tax liability if his taxable income is $32,000 and he is in the 12% tax bracket?

b.How much is his tax liability if his taxable income is $171,000 and his tax bracket is 32% (not

12%)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Juan was considering purchasing an interest in

Q91: During 2019, Madison had salary income of

Q95: What are the effects of a below-market

Q96: Sharon made a $60,000 interest-free loan to

Q105: Our tax laws encourage taxpayers to assets

Q110: Margaret owns land that appreciates at the

Q111: On January 1, 2019, Faye gave Todd,

Q112: Ted was shopping for a new automobile.

Q116: In January 2019, Tammy purchased a bond

Q117: In the case of a zero interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents