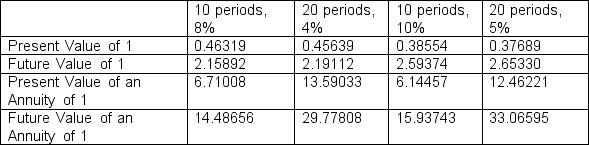

Stevens Company is about to issue $400,000 of 10-year bonds paying an 8% interest rate with interest payable semiannually. The effective interest rate for such securities is 10%. Below are available time value of money factors that Stevens chooses from to calculate compounded interest.

To the closest dollar, how much can Stevens expect to receive for the sale of these bonds?

To the closest dollar, how much can Stevens expect to receive for the sale of these bonds?

a. $350,151

b. $292,637

c. $800,000

d. $1,405,503

Correct Answer:

Verified

Q22: Companies generate assets in three different ways.

Q29: Bonds payable that are redeemed by the

Q31: A non-interest-bearing note was recorded in the

Q33: On January 1, a 3-year, $8,000, non-interest-bearing

Q38: Which one of the following is not

Q43: The following information was extracted from the

Q45: Crosson Company uses the straight-line method of

Q53: Investments in bonds are accounted for using

A)historical

Q55: Countries throughout the world typically

A)pay extremely large

Q58: Woodsman Company issued $400,000 of 6-year, 6%

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents