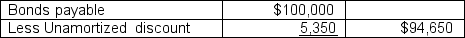

Barkley Brothers Inc. shows the following information on its balance sheet for December 31, 2010.

The bonds have a stated annual interest rate of 5 percent and will mature on December 31, 2012. The market value of the bonds as of December 31, 2010, is $98,167. Assume that Barkley retired the bonds by purchasing them on the open market. The journal entry to record this purchase would include:

The bonds have a stated annual interest rate of 5 percent and will mature on December 31, 2012. The market value of the bonds as of December 31, 2010, is $98,167. Assume that Barkley retired the bonds by purchasing them on the open market. The journal entry to record this purchase would include:

a. a credit to Bonds Payable for $100,000.

b. a debit to Discount on Bonds Payable for $5,350.

c. a credit to Discount on Bonds Payable for $5,350.

d. a debit to Cash for $98,167.

Correct Answer:

Verified

Q42: Gibson Corporation amortizes its bonds using the

Q49: Operating leases are treated as

A)increases in liabilities

Q61: Duncan Industries sold $100,000 of 12 percent

Q62: On January 1, 2010, Hooper Corporation issued

Q63: On January 1, 2009, Enron Corporation issued

Q65: Duncan Industries sold $100,000 of 12 percent

Q66: Bowlin Company issued $1,000,000 of 9 percent,

Q67: Duncan Industries sold $100,000 of 12 percent

Q68: On January 1, 2009, Pacific Corporation issued

Q69: On January 1, 2010, Lukens Corporation issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents