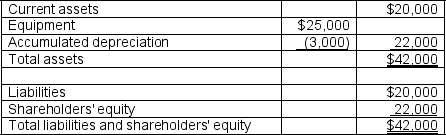

On January 1, 2009, Grant Company leased telephone equipment from Xu, Inc. Grant uses straight-line depreciation. The contract requires Grant to pay $5,000 each December 31 for the next three years, at which time the equipment is to be returned to Xu. Using an interest rate of 8%, the present value of the lease payments is $12,885. The following is Grant's January 1, 2009, balance sheet before the lease agreement.

Calculate and compare Grant's debt/equity ratios on January 1, 2009, immediately after the lease is signed, as an operating lease and a capital lease.

Calculate and compare Grant's debt/equity ratios on January 1, 2009, immediately after the lease is signed, as an operating lease and a capital lease.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: On January 1, 2009, Standard Incorporated is

Q87: On January 1, 2009, Alcon Corporation issued

Q88: On January 1, 2010, Foster Corporation issued

Q89: On January 1, 2010, Gee Company issued

Q90: On January 1, 2009, Luna Corporation issued

Q92: On January 1, 2009, Field Corporation issued

Q93: On January 1, 2009, Richardson Company leased

Q94: On January 1, 2009 Frank Corporation issued

Q95: On January 1, 2009, Edison Corporation issued

Q96: On December 31, 2009, Creative Corporation issued

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents