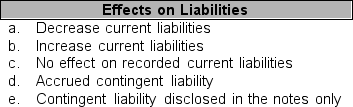

For each item numbered 1 through 16 below, select the appropriate effect on liabilities listed in a through e that each transaction describes. You may use each letter more than once or not at all. In some cases, two effects are correct.

____ 1. Purchased supplies on account.

____ 1. Purchased supplies on account.

____ 2. Paid accounts payable.

____ 3. Issued a $1,000 short-term note payable for $970.

____ 4. Amortized the discount of the short-term note payable.

____ 5. A portion of long-term debt is due next year.

____ 6. Declared cash dividends to holders of stock.

____ 7. Paid the cash dividend previously declared.

____ 8. Received money from customers prior to delivery of the product to the customer.

____ 9. Delivered products to a customer who previously paid for that product.

____ 10. Collected sales tax on behalf of the state government.

____ 11. Accrued payroll taxes that the firm has to pay to the federal government within three months.

____ 12. Accrued a bonus amounting to 5% on reported income to the CEO.

____ 13. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is remote.

____ 14. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is reasonably possible.

____ 15. In a lawsuit filed against the firm, counsel indicates that the potential $10,000 loss is highly probable.

____ 16. Accrued warranty expense.

Correct Answer:

Verified

Q61: Julia Used Cars offers a one-year warranty

Q62: On December 31, 2008, Seminole Co. had

Q62: On July 1, Gordon Company borrowed $10,000

Q63: The following information was taken from the

Q64: Pacific Company estimates warranty expense as 10%

Q67: On October 1, Accurate Company borrowed $2,000

Q67: On December 31, 2009, Roper Company had

Q68: The following information was taken from the

Q69: As a security analyst for Market Masters,

Q71: Julia Used Cars offers a one-year warranty

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents