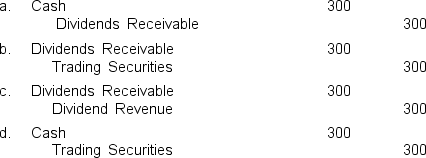

An investor owns trading equity securities in Noah Company. Noah Company declared dividends of $300 during July. What entry is required in August when the dividends are received?

Correct Answer:

Verified

Q13: Investments in equity securities are current assets

Q14: Income from trading and available-for-sale equity securities

Q15: Available-for-sale securities are:

A) actively 'traded' on the

Q16: Torborg Corp. purchased available-for-sale securities from Hensley

Q17: The recognition of unrealized gains on available-for-sale

Q19: When a company accounts for an investment

Q20: Trading securities of Sanchez Inc. were purchased

Q21: Walsh Company purchased 1,000 shares of Pierce

Q23: The cost method of accounting for long-term

Q24: The consolidation procedure of accounting for long-term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents