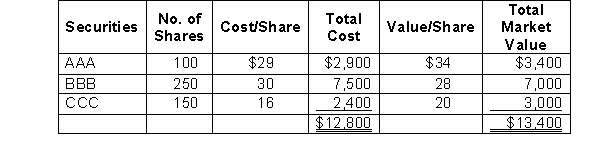

The following information related to the marketable security investments of Solo Company. Securities held on December 31, 2009, as described in the table below. AAA and BBB are classified as trading securities and CCC is classified as an available-for-sale security.  Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the dividends received on the BBB securities and the dividends declared on the CCC stock in 2010 will include:

Early in 2010, the company sold 50 shares of BBB for $26 per share. During 2010, Solo received dividends of $3 per share on the remaining 200 shares of BBB, and dividends of $2.50 per share were declared, but not yet received on the 150 shares of CCC stock. The per-share market values of BBB and CCC on December 31, 2010, were $24 and $18, respectively. During 2011, Solo sold the remaining 200 shares of BBB stock for $26 per share and the 150 shares of CCC for $22 per share. The journal entry to record the dividends received on the BBB securities and the dividends declared on the CCC stock in 2010 will include:

A) A credit to Dividend Revenue for $975.

B) A credit to Dividend Payable for $375.

C) A credit to Cash for $600.

D) A debit to Dividend Expense for $375.

Correct Answer:

Verified

Q70: On December 31, 2010, available-for-sale securities with

Q71: On December 31, 2010, trading securities with

Q72: The following information related to the marketable

Q73: The following information related to the marketable

Q74: Each transaction listed in 1 through 4

Q76: On December 31, 2010, trading securities with

Q77: Each transaction listed in 1 through 4

Q78: The following information related to the marketable

Q79: Matching Questions

-Each transaction numbered 1 through 5

Q80: Trading securities were purchased at a cost

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents