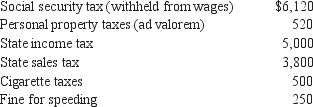

Karen Baker, a cash basis calendar year taxpayer, paid the following during the year:  What itemized deduction may Karen claim for taxes on her return?

What itemized deduction may Karen claim for taxes on her return?

A) $5,520

B) $9,820

C) $15,420

D) $16,190

E) None of the above

Correct Answer:

Verified

Q55: Which one of the following is not

Q56: Cathy buys a house (her principal residence)

Q57: Darrin owns a house with a FMV

Q58: A business machine valued at $800 was

Q59: Unnecessary cosmetic surgery costs directed solely at

Q61: During the year, George Gable, age 66,

Q62: John Jones incurred the following interest items

Q63: Which of the following would Diana Collier

Q64: Frank Fox won $10,000 in a state

Q65: Kenneth Kruise purchased a personal residence for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents