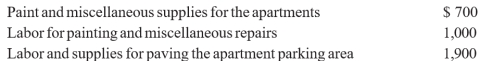

Jerry, a general contractor by trade, is a tenant of Montgomery Apartments. In exchange for four months rent ($900/month) , Jerry provided the following items and services for Paul, the owner of the apartments:  How should Paul treat this transaction on his 2012 Schedule E?

How should Paul treat this transaction on his 2012 Schedule E?

A) Rental income of $3,600 and rental expenses of $3,600.

B) No rental income or rental expenses are to be reflected on the Schedule E because the net effect is 0.

C) Rental income of $3,600 and depreciation computed on the capital expenditures of $3,600.

D) Rental income of $3,600, rental expenses of $1,700, and depreciation computed on the capital expenditures of $1,900.

Correct Answer:

Verified

Q55: Which one of the following distributions is

Q56: During 2012, Milton Hanover was granted a

Q57: Troy, a cash basis taxpayer, owns an

Q58: With regard to stock dividends, all of

Q59: In July 1997, Dan Farley leased a

Q61: Bob Buttons, a cash basis calendar year

Q62: Holly and Harp Oaks were divorced in

Q63: John, a cash basis taxpayer, had a

Q64: In 2012, Norm, a carpenter, received a

Q65: Which of the following in not a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents