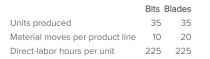

Forrest Company manufactures sophisticated industrial drill bits and saw blades used in heavy construction projects.The company is now preparing its annual profit plan.As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the following information.  The total budgeted material-handling cost is $75,000. Required: 1.Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one lens would be what amount? 2.Answer the same question as in requirement 1, but for mirrors. 3.Under activity-based costing (ABC), the material-handling costs allocated to one lens would be what amount? The cost driver for the material-handling activity is the number of material moves. 4.Answer the same question as in requirement 3, but for mirrors.

The total budgeted material-handling cost is $75,000. Required: 1.Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one lens would be what amount? 2.Answer the same question as in requirement 1, but for mirrors. 3.Under activity-based costing (ABC), the material-handling costs allocated to one lens would be what amount? The cost driver for the material-handling activity is the number of material moves. 4.Answer the same question as in requirement 3, but for mirrors.

Correct Answer:

Verified

$7...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q78: Which of the following is not an

Q115: Tanner Industries manufactures high-end speakers and sub-woofers.The

Q116: Which of the following can have a

Q118: A hospital administrator is in the process

Q119: An example of a customer-value-added activity is:

A)final

Q120: Of the following organizations, activity-based costing (ABC)

Q121: At a recent professional meeting, two controllers

Q122: Germaine Lotions and Mystic Oils uses a

Q124: Consider the nine activities that follow. 1.A

Q125: Define the term "cost driver" and discuss

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents