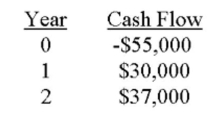

You would like to invest in the following project.  Victoria, your boss, insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted. She also insists on applying a 10 percent discount rate to all cash

Victoria, your boss, insists that only projects that can return at least $1.10 in today's dollars for every $1 invested can be accepted. She also insists on applying a 10 percent discount rate to all cash

flows. Based on these criteria, you should:

A) Accept the project because it returns almost $1.22 for every $1 invested.

B) Accept the project because it has a positive PI.

C) Accept the project because the NPV is $2,851.

D) Reject the project because the PI is 1.05.

E) Reject the project because the IRR exceeds 10 percent.

Correct Answer:

Verified

Q200: Without using formulas, provide a definition of

Q201: Ginny Trueblood is considering an investment which

Q202: Elderkin & Martin is considering an investment

Q203: Under the payback method of analysis:

A) The

Q204: A project has average net income of

Q206: You are going to choose between two

Q207: Sal is considering a project that costs

Q208: For which capital investment evaluation technique is

Q209: When the present value of the cash

Q210: An investment's average net income divided by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents