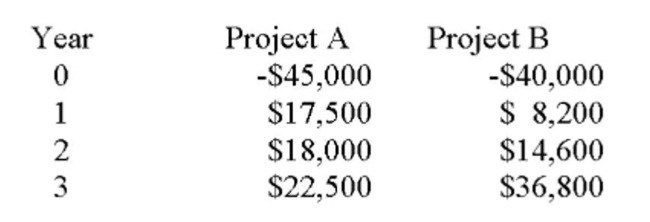

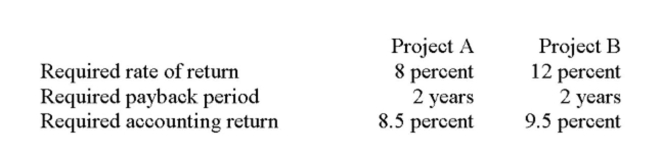

You are considering the following two mutually exclusive projects with the following cash flows. Both projects will be depreciated using straight-line depreciation to a zero book value over the life

Of the project. Neither project has any salvage value.

You should accept Project _____ because its net present value exceeds that of the other project by

You should accept Project _____ because its net present value exceeds that of the other project by

_____.

A) A; $418.02

B) A; $897.13

C) B; $656.94

D) B; $778.11

E) B; $813.27

Correct Answer:

Verified

Q231: Which of the following decision rules has

Q239: All else equal, the payback period for

Q241: The net present value of a project

Q242: Assuming that straight line depreciation is used,

Q243: Average accounting return is defined as:

A) Average

Q247: Use the following mutually exclusive investment cash

Q248: You are considering the following projects but

Q249: Generally, the most difficult part of utilizing

Q254: The internal rate of return should:

A) Not

Q271: An advantage of the payback method is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents