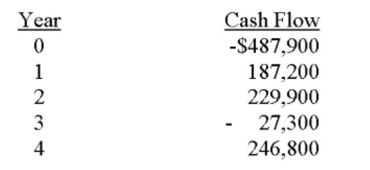

Bridgewater Fountains is considering expanding its current line of business and has developed the following expected cash flows for the project. Should this project be accepted based on the

Discounting approach to the modified internal rate of return if the discount rate is 9.6 percent? Why

Or why not?

A) Yes; The IRR is 9.11 percent.

B) Yes; The IRR is 11.87 percent.

C) Yes; The IRR is 11.99 percent.

D) No; The IRR is 11.87 percent.

E) No; The IRR is 11.99 percent.

Correct Answer:

Verified

Q392: Compare and contrast the advantages and disadvantages

Q395: How does the net present value method

Q396: Without using formulas, provide a definition of

Q399: You are considering two independent projects, both

Q400: What is the reasoning or logic behind

Q401: A project has multiple IRRs. Which should

Q401: Without using formulas, provide a definition of

Q402: Without using formulas, provide a definition of

Q403: List and identify the discounted cash flow

Q412: Explain why the internal rate of return

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents