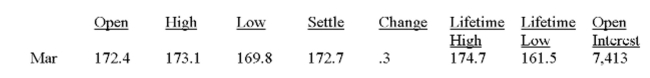

You are the purchasing agent for a food producer. You anticipate that your firm will need 160,000 bushels of oats in March. You decide to hedge your position today and did so at the closing price of

The day. Assume that the actual market price turns out to be 174.6 on the day you actually buy the

Oats. By buying the contract you:

Oats - 5,000 bu.; cents per bu.

A) Saved $1,080.

B) Saved $3,040.

C) Saved $4,800.

D) Spent an additional $1,080.

E) Spent an additional $3,040.

Correct Answer:

Verified

Q210: An option that gives the owner the

Q238: You are the buyer for a cereal

Q239: A put option can best be defined

Q241: The difference between a futures contract and

Q245: You grow wheat and figure that you

Q248: Which one of the following methods of

Q249: You are a grain exporter and need

Q250: A cereal company generally enters into a

Q253: A farmer generally enters into a forward

Q256: The seller of a forward contract has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents