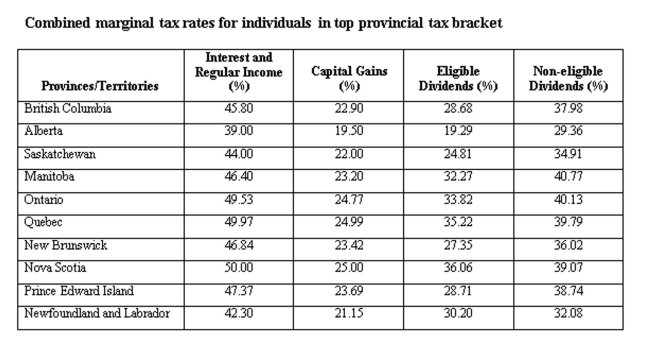

A New Brunswick resident earned $20,000 in interest income and $10,000 in capital gains. Calculate the average tax rate.

A) 40.03%

B) 39.03%

C) 38.03%

D) 37.03%

E) 36.03%

Correct Answer:

Verified

Q214: A Quebec resident earned $20,000 in interest

Q215: A Manitoba resident earned $40,000 in interest

Q216: A British Columbia resident earned $40,000 in

Q217: Determined the federal marginal tax rate of

Q218: A Nova Scotia resident earned $20,000 in

Q220: Given the tax rates below, what is

Q221: Which of the following is NOT a

Q222: Which one of the following will cause

Q223: Which one of the following will increase

Q239: Dividend tax credit is best described as:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents