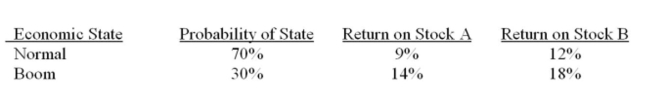

What is the standard deviation of a portfolio that is invested 40% in stock A and 60% in stock B, given the following information?

A) 2.18%

B) 2.57%

C) 2.69%

D) 2.84%

E) 3.13%

Correct Answer:

Verified

Q118: The stock of Martin Industries has a

Q170: Asset A has an expected return of

Q172: What is the portfolio weight of stock

Q173: An investor has a portfolio with 30%

Q174: You own the following portfolio of stocks.

Q177: A portfolio has an expected return of

Q178: What is the standard deviation of returns

Q179: What is the expected portfolio return given

Q180: What is the expected return on a

Q181: What is the expected return on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents