Andie earned $680.20 during the most recent weekly pay period. She is single with 3 withholding allowances and needs to decide between contributing 2.5% and $25 to her 401(k) plan. If she chooses the method that results in the lowest taxable income, how much will be withheld for Federal income tax (based on

The following table) ?

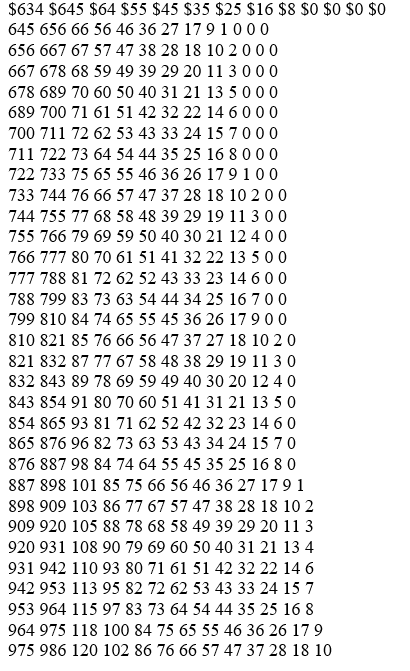

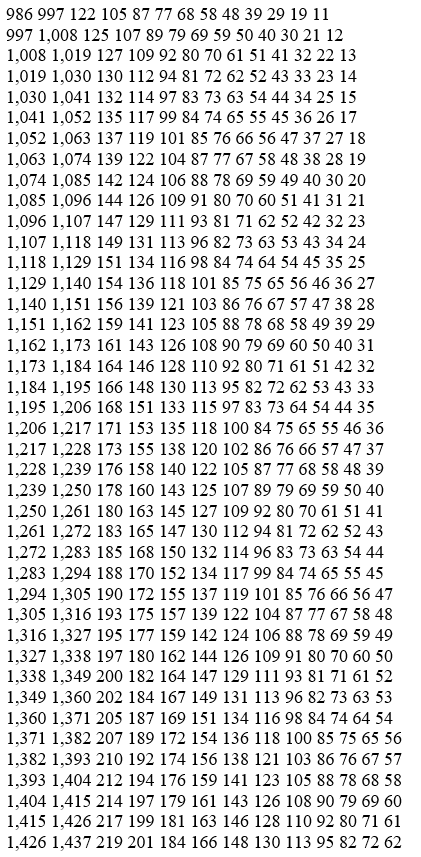

Wage Bracket Method Tables for Income Tax Withholding

SINGLE Persons-WEEKLY Payroll Period

(For Wages Paid through December 2019)

And the wages are And the number of withholding allowances claimed is-

At least But lessthan 0 1 2 3 4 5 6 7 8 9 10

The amount of income tax to be withheld is-

A) $40.00

B) $48.00

C) $36.00

D) $39.00

Correct Answer:

Verified

Q33: Paolo is a part-time security guard for

Q34: Adam is a part-time employee who earned

Q35: Brent is a full-time exempt employee in

Q36: Melody is a full-time employee in Sioux

Q37: Olga earned $1,558.00 during the most recent

Q39: Jeannie is an adjunct faculty at a

Q40: Renee is a salaried exempt employee who

Q41: Which of the following is the correct

Q42: What is a disadvantage to using paycards

Q43: The annual payroll tax guide that the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents