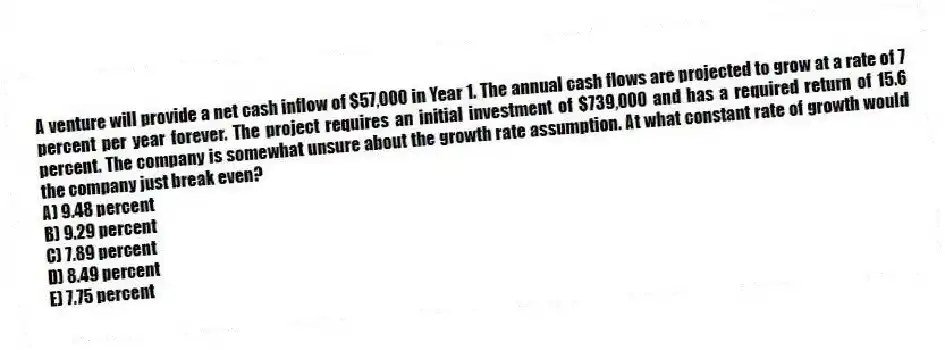

A venture will provide a net cash inflow of $57,000 in Year 1. The annual cash flows are projected to grow at a rate of 7 percent per year forever. The project requires an initial investment of $739,000 and has a required return of 15.6 percent. The company is somewhat unsure about the growth rate assumption. At what constant rate of growth would the company just break even?

A) 9.48 percent

B) 9.29 percent

C) 7.89 percent

D) 8.49 percent

E) 7.75 percent

Correct Answer:

Verified

Q98: Drinkable Water Systems is analyzing a project

Q99: A project has cash flows of -$152,000,

Q100: Project A has cash flows of −$50,000,

Q101: You estimate that a project will cost

Q102: Assume a project has cash flows of

Q103: Project A costs $47,800 with cash inflows

Q105: A project has cash flows of -$152,000,

Q106: TL Lumber is evaluating a project with

Q107: The relevant discount rate is 14 percent

Q108: A project has a discount rate of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents