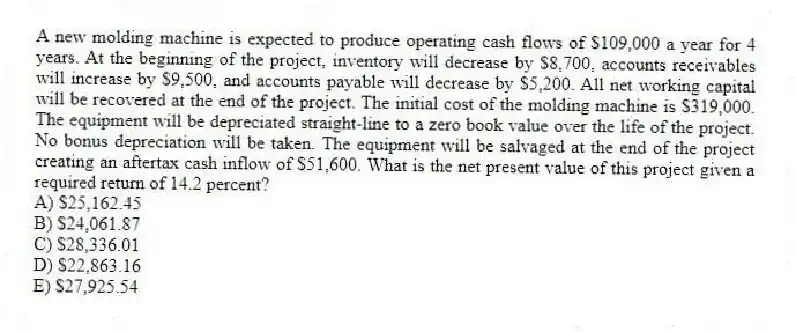

A new molding machine is expected to produce operating cash flows of $109,000 a year for 4 years. At the beginning of the project, inventory will decrease by $8,700, accounts receivables will increase by $9,500, and accounts payable will decrease by $5,200. All net working capital will be recovered at the end of the project. The initial cost of the molding machine is $319,000. The equipment will be depreciated straight-line to a zero book value over the life of the project. No bonus depreciation will be taken. The equipment will be salvaged at the end of the project creating an aftertax cash inflow of $51,600. What is the net present value of this project given a required return of 14.2 percent?

A) $25,162.45

B) $24,061.87

C) $28,336.01

D) $22,863.16

E) $27,925.54

Correct Answer:

Verified

Q47: Dan is comparing three machines to determine

Q48: Cool Comfort currently sells 340 Class A

Q49: Decreasing which one of the following will

Q50: The Lunch Counter is expanding and expects

Q51: The maintenance expenses on a rental house

Q53: Ausel's is considering a five-year project that

Q54: The equivalent annual cost method is useful

Q55: The equivalent annual cost considers all of

Q56: A project will produce an operating cash

Q57: W&M paid $179,000, in cash, for equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents