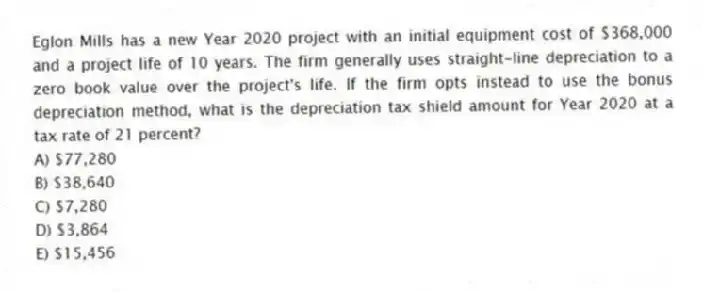

Eglon Mills has a new Year 2020 project with an initial equipment cost of $368,000 and a project life of 10 years. The firm generally uses straight-line depreciation to a zero book value over the project's life. If the firm opts instead to use the bonus depreciation method, what is the depreciation tax shield amount for Year 2020 at a tax rate of 21 percent?

A) $77,280

B) $38,640

C) $7,280

D) $3,864

E) $15,456

Correct Answer:

Verified

Q56: A project will produce an operating cash

Q57: W&M paid $179,000, in cash, for equipment

Q58: Which one of the following would make

Q59: Assume you are considering two mutually exclusive

Q60: Kelly's Corner Bakery purchased a lot in

Q62: Better Beverages purchased $139,700 of fixed assets

Q63: Pre-Fab purchased some equipment two years ago

Q64: Russell's is considering purchasing $697,400 of equipment

Q65: Phone Home, Inc. is considering a new

Q66: The Market Place is considering a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents