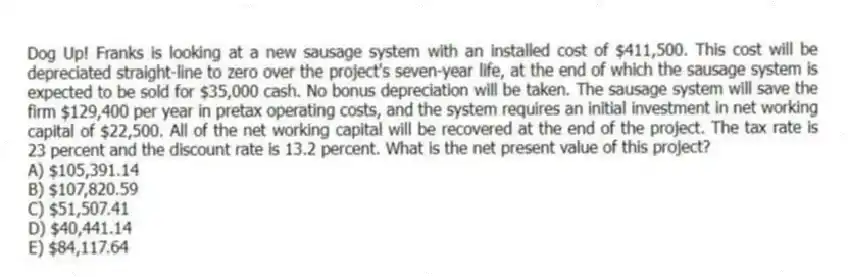

Dog Up! Franks is looking at a new sausage system with an installed cost of $411,500. This cost will be depreciated straight-line to zero over the project's seven-year life, at the end of which the sausage system is expected to be sold for $35,000 cash. No bonus depreciation will be taken. The sausage system will save the firm $129,400 per year in pretax operating costs, and the system requires an initial investment in net working capital of $22,500. All of the net working capital will be recovered at the end of the project. The tax rate is 23 percent and the discount rate is 13.2 percent. What is the net present value of this project?

A) $105,391.14

B) $107,820.59

C) $51,507.41

D) $40,441.14

E) $84,117.64

Correct Answer:

Verified

Q65: Phone Home, Inc. is considering a new

Q66: The Market Place is considering a new

Q67: Keyser Mining is considering a project that

Q68: A proposed three-year project will require $589,000

Q69: Home Furnishings is expanding its product offerings

Q71: You just purchased $218,000 of equipment that

Q72: A project will require $543,000 for fixed

Q73: You own some equipment that you purchased

Q74: The Card Shoppe needs to maintain 21

Q75: Consider a project with an initial asset

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents