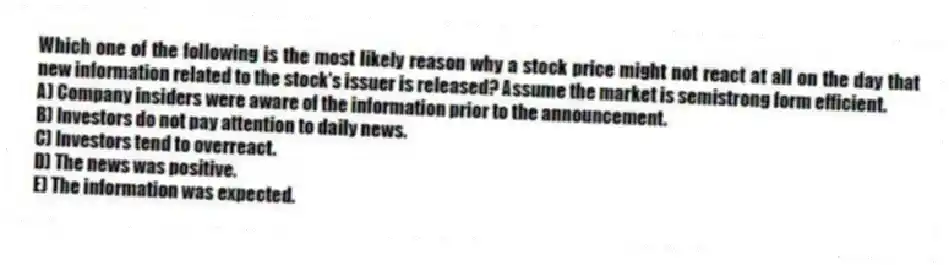

Which one of the following is the most likely reason why a stock price might not react at all on the day that new information related to the stock's issuer is released? Assume the market is semistrong form efficient.

A) Company insiders were aware of the information prior to the announcement.

B) Investors do not pay attention to daily news.

C) Investors tend to overreact.

D) The news was positive.

E) The information was expected.

Correct Answer:

Verified

Q38: Which one of the following best defines

Q39: Which one of the following categories of

Q40: The average compound return earned per year

Q41: Which form of market efficiency would most

Q42: One year ago, you purchased a stock

Q44: Individual investors who continually monitor the financial

Q45: Six months ago, you purchased 300 shares

Q46: You own 850 shares of Western Feed

Q47: Which one of the following statements is

Q48: Efficient financial markets fluctuate continuously because:

A) the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents