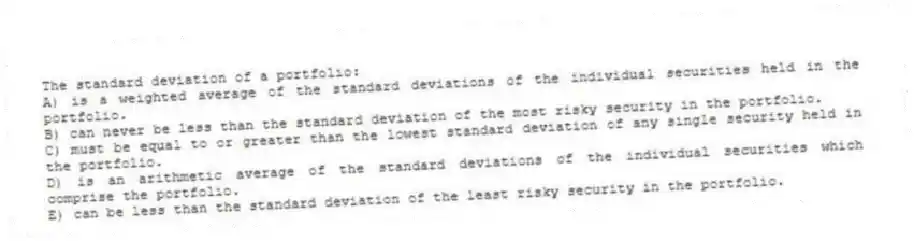

The standard deviation of a portfolio:

A) is a weighted average of the standard deviations of the individual securities held in the portfolio.

B) can never be less than the standard deviation of the most risky security in the portfolio.

C) must be equal to or greater than the lowest standard deviation of any single security held in the portfolio.

D) is an arithmetic average of the standard deviations of the individual securities which comprise the portfolio.

E) can be less than the standard deviation of the least risky security in the portfolio.

Correct Answer:

Verified

Q1: The expected return on a stock given

Q2: Which one of the following events would

Q3: Which one of the following is a

Q5: The expected risk premium on a stock

Q6: Which one of the following statements is

Q7: Which one of the following is an

Q8: The expected return on a stock computed

Q9: Steve has invested in twelve different stocks

Q10: You own a stock that you think

Q11: The standard deviation of a portfolio:

A) is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents