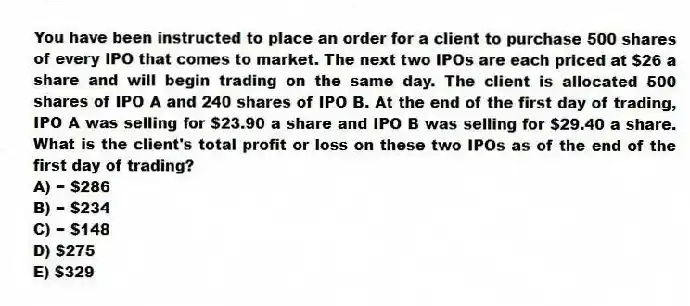

You have been instructed to place an order for a client to purchase 500 shares of every IPO that comes to market. The next two IPOs are each priced at $26 a share and will begin trading on the same day. The client is allocated 500 shares of IPO A and 240 shares of IPO B. At the end of the first day of trading, IPO A was selling for $23.90 a share and IPO B was selling for $29.40 a share. What is the client's total profit or loss on these two IPOs as of the end of the first day of trading?

A) − $286

B) − $234

C) − $148

D) $275

E) $329

Correct Answer:

Verified

Q38: All of the following are supporting arguments

Q39: Individual investors might avoid requesting 100 shares

Q40: If a firm commitment IPO is overpriced

Q41: Shelf registration allows a firm to register

Q42: Roy owns 200 shares of RTF Inc.

Q44: Which one of the following statements is

Q45: The value of a right depends upon

Q46: BK & Co. offered 15,000 shares in

Q47: To purchase a share in a rights

Q48: Before a seasoned stock offering, you owned

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents