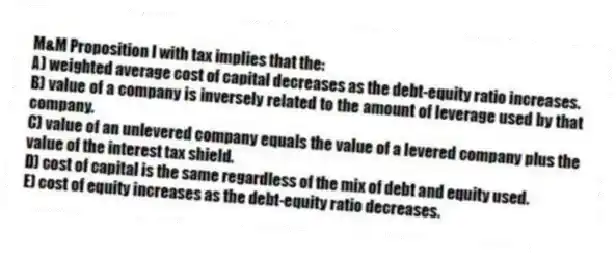

M&M Proposition I with tax implies that the:

A) weighted average cost of capital decreases as the debt-equity ratio increases.

B) value of a company is inversely related to the amount of leverage used by that company.

C) value of an unlevered company equals the value of a levered company plus the value of the interest tax shield.

D) cost of capital is the same regardless of the mix of debt and equity used.

E) cost of equity increases as the debt-equity ratio decreases.

Correct Answer:

Verified

Q29: The optimal capital structure of a company:

A)

Q30: Which one of the following provides the

Q31: The present value of the interest tax

Q32: Westover Mills reduced its taxes last year

Q33: The basic lesson of M&M theory is

Q35: If a company has the optimal amount

Q36: The costs incurred by a business in

Q37: Based on M&M Proposition I with taxes,

Q38: The optimal capital structure:

A) will be the

Q39: Which one of the following is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents