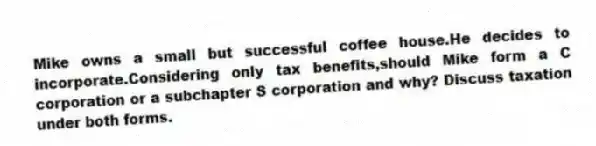

Mike owns a small but successful coffee house.He decides to incorporate.Considering only tax benefits,should Mike form a C corporation or a subchapter S corporation and why? Discuss taxation under both forms.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q47: The _ set forth the steps that

Q49: Define a joint venture and list the

Q51: _ of a general partnership occurs when

Q56: If incorporators cannot show substantial compliance with

Q57: In _ voting,a shareholder can cast one

Q58: Which of the following refers to a

Q62: Explain requirements for formation of an S

Q63: Set forth four of the shareholder proposals

Q64: Fact Pattern 19-2

Maxine and Vince verbally agree

Q66: Fact Pattern 19-2

Maxine and Vince verbally agree

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents