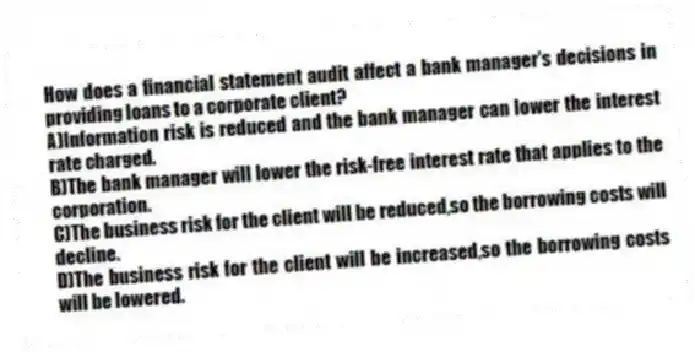

How does a financial statement audit affect a bank manager's decisions in providing loans to a corporate client?

A) Information risk is reduced and the bank manager can lower the interest rate charged.

B) The bank manager will lower the risk-free interest rate that applies to the corporation.

C) The business risk for the client will be reduced,so the borrowing costs will decline.

D) The business risk for the client will be increased,so the borrowing costs will be lowered.

Correct Answer:

Verified

Q34: Information risk can be reduced through any

Q35: What is the most appropriate method for

Q36: The risk that financial statements may be

Q37: Which of the following is an example

Q38: The underlying conditions that create demand by

Q40: Which of the following terms best describes

Q41: What impact is the presence of factors

Q42: The need to implement philosophies and practices

Q43: Two types of services provided by public

Q44: The No-Name Agency conducts an independent service

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents