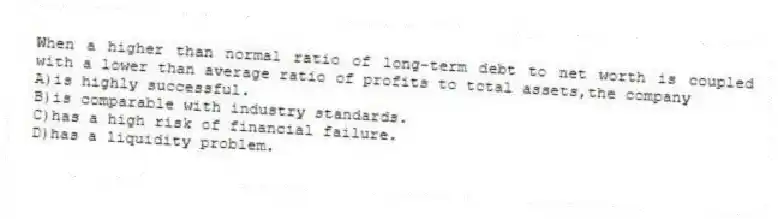

When a higher than normal ratio of long-term debt to net worth is coupled with a lower than average ratio of profits to total assets,the company

A) is highly successful.

B) is comparable with industry standards.

C) has a high risk of financial failure.

D) has a liquidity problem.

Correct Answer:

Verified

Q56: A)Distinguish between internal documentation and external documentation

Q57: An example of an internal document is

A)a

Q58: When comparing the reliability of external versus

Q59: Following are examples of evidence that could

Q60: An auditor is conducting the audit of

Q62: An important benefit of industry comparisons is

Q63: The audit working papers serve as a

Q64: Renaldo compared shipping reports to sales documents,checking

Q65: Which of the following would you expect

Q66: Each working paper should include enough information

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents