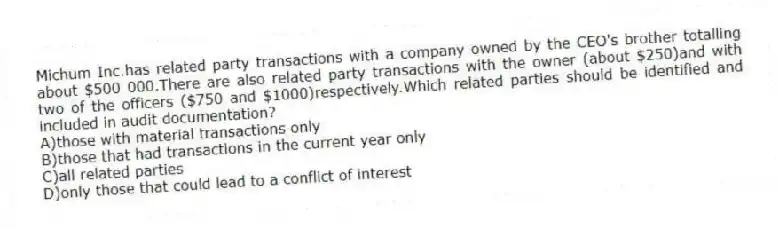

Michum Inc.has related party transactions with a company owned by the CEO's brother totalling about $500 000.There are also related party transactions with the owner (about $250) and with two of the officers ($750 and $1000) respectively.Which related parties should be identified and included in audit documentation?

A) those with material transactions only

B) those that had transactions in the current year only

C) all related parties

D) only those that could lead to a conflict of interest

Correct Answer:

Verified

Q11: Risks associated with specific industries may affect

Q12: Brandon is working on the audit of

Q13: What are the possible scope limitations that

Q14: What are the preliminary engagement activities performed

Q15: An effective audit is one that

A)reduces the

Q17: During the process of deciding to accept

Q18: What is the best description of the

Q19: The Canadian Auditing Standards state that the

Q20: An important reason for auditors to obtain

Q21: Vanovo Ltd.has purchased several companies in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents