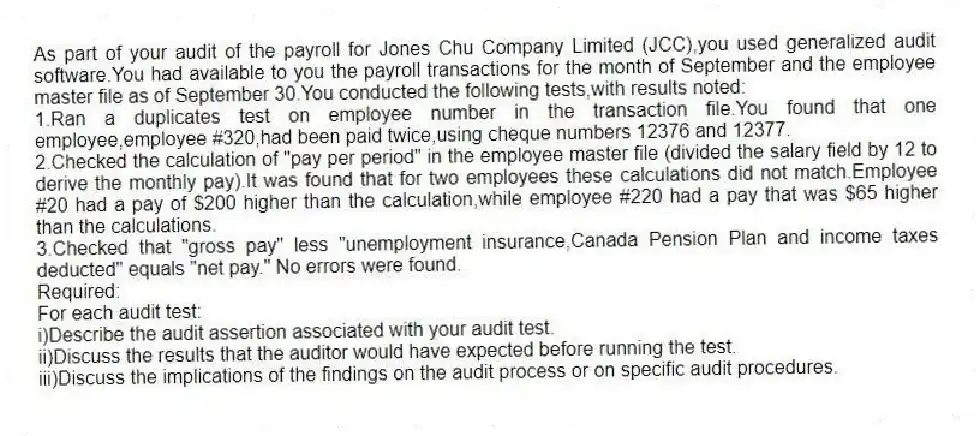

As part of your audit of the payroll for Jones Chu Company Limited (JCC),you used generalized audit software.You had available to you the payroll transactions for the month of September and the employee master file as of September 30.You conducted the following tests,with results noted:

1.Ran a duplicates test on employee number in the transaction file.You found that one employee,employee #320,had been paid twice,using cheque numbers 12376 and 12377.

2.Checked the calculation of "pay per period" in the employee master file (divided the salary field by 12 to derive the monthly pay).It was found that for two employees these calculations did not match.Employee #20 had a pay of $200 higher than the calculation,while employee #220 had a pay that was $65 higher than the calculations.

3.Checked that "gross pay" less "unemployment insurance,Canada Pension Plan and income taxes deducted" equals "net pay." No errors were found.

Required:

For each audit test:

i)Describe the audit assertion associated with your audit test.

ii)Discuss the results that the auditor would have expected before running the test.

iii)Discuss the implications of the findings on the audit process or on specific audit procedures.

Correct Answer:

Verified

ii)Assert...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: The WhirlyGig Factory Ltd.manufactures whirly gigs of

Q38: Joan has been the payroll supervisor at

Q39: The careful and timely preparation of all

Q40: To test whether the client has fulfilled

Q41: Which of the following is a substantive

Q43: Even though the tests of controls are

Q44: "Recorded payroll transactions are for the amount

Q45: Which of the following is most likely

Q46: Otto decided to outsource the payroll function

Q47: Which of the following internal controls helps

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents