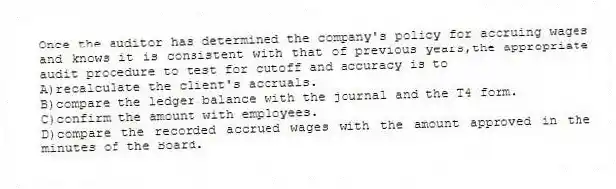

Once the auditor has determined the company's policy for accruing wages and knows it is consistent with that of previous years,the appropriate audit procedure to test for cutoff and accuracy is to

A) recalculate the client's accruals.

B) compare the ledger balance with the journal and the T4 form.

C) confirm the amount with employees.

D) compare the recorded accrued wages with the amount approved in the minutes of the Board.

Correct Answer:

Verified

Q64: Because of the lack of available evidence,it

Q65: A form issued for each employee summarizing

Q66: The auditor's primary concern in testing payroll

Q67: In auditing the imprest payroll account,which of

Q68: The correct cutoff and valuation of accrued

Q69: Verification of the legitimacy of year-end unpaid

Q70: Which of the following procedures carried out

Q71: An important consideration in evaluating the fairness

Q72: State the six specific transactions-related audit objectives

Q74: List examples of substantive test of details

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents