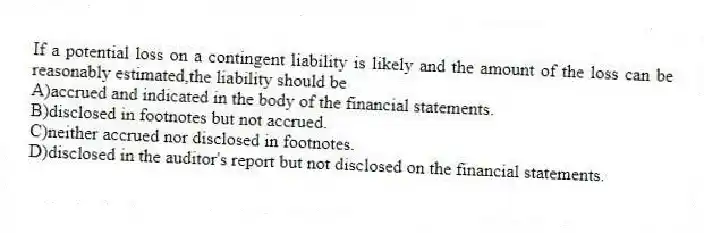

If a potential loss on a contingent liability is likely and the amount of the loss can be reasonably estimated,the liability should be

A) accrued and indicated in the body of the financial statements.

B) disclosed in footnotes but not accrued.

C) neither accrued nor disclosed in footnotes.

D) disclosed in the auditor's report but not disclosed on the financial statements.

Correct Answer:

Verified

Q3: IFRS uses specific terminology to refer to

Q4: What situation represents a contingent liability for

Q5: Which level of risk does the auditor

Q6: An agreement that commits the firm to

Q7: If a potential loss on a contingent

Q8: Which of the following procedures might be

Q9: When the proper disclosure in the financial

Q10: State the three conditions required for a

Q11: The auditor's responsibility with regards to contingent

Q51: Discuss three audit procedures commonly used to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents