Garber Corporation had 40,000 shares of $10 par common stock outstanding on January 1, Year 1. On June 1, Year 1 Garber purchased 5,000 shares of its own stock on the open market for $22 per share and held it as treasury stock. On October 1, Year 1 Garber declared and issued a 10% stock dividend. The market value of Garber's stock was $24 per share on October 1. Garber's board of directors declared and paid a cash dividend of $57,750 on December 15, Year 1.

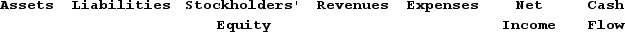

Required:Show how the purchase of the treasury stock affects the financial statements.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: What is a common reason for a

Q35: Will the number of shares of stock

Q39: Garber Corporation had 20,000 shares of $12

Q40: What is treasury stock?

Q134: Loudoun Corporation's balance sheet reflected the

Q139: Vortex Corporation has 250,000 shares of common

Q140: On January 1, Year 1, the organizers

Q141: Jalisco, Incorporated, had issued and outstanding 250,000

Q143: The corporate charter of Pinkston Corporation

Q144: Turner Corporation has 150,000 shares of $12

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents