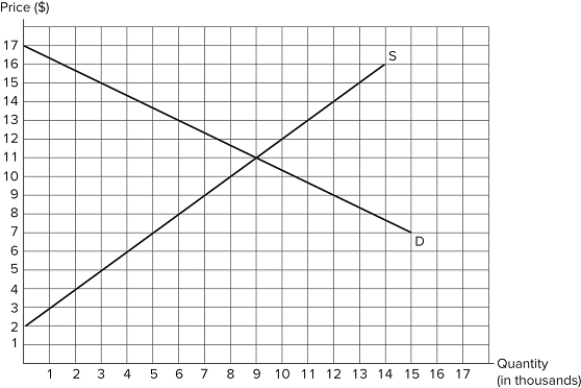

Suppose a $5 tax is imposed on sellers in the market shown in the graph. Which of the following statements is true?Producers bear more of the tax burden than consumers.The tax-inclusive price (or after-tax price) received by sellers is $8.The deadweight loss is $15,000.

Suppose a $5 tax is imposed on sellers in the market shown in the graph. Which of the following statements is true?Producers bear more of the tax burden than consumers.The tax-inclusive price (or after-tax price) received by sellers is $8.The deadweight loss is $15,000.

A) I only

B) II and III only

C) I and II only

D) I, II, and III

Correct Answer:

Verified

Q87: A tax on sellers:

A) causes equilibrium price

Q88: {MISSING IMAGE}Suppose an $8 tax is imposed

Q89: A tax wedge:

A) refers to the difference

Q90: Q91: When a tax is imposed on a Q93: How can a government ensure all producers Q94: A tax on sellers shifts the _ Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()