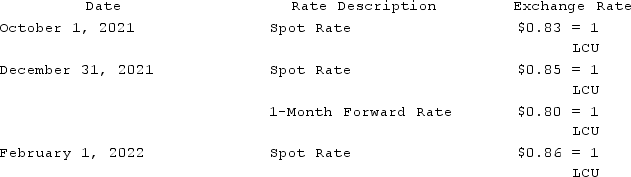

On October 1, 2021, Jarvis Co. sold inventory to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection is expected in four months. On October 1, 2021, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2022)and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows:

The company's borrowing rate is 12%. The present value factor for one month is 0.9901.Any discount or premium on the contract is amortized using the straight-line method.Assuming this is a cash flow hedge; prepare journal entries for this sales transaction and forward contract.

The company's borrowing rate is 12%. The present value factor for one month is 0.9901.Any discount or premium on the contract is amortized using the straight-line method.Assuming this is a cash flow hedge; prepare journal entries for this sales transaction and forward contract.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Authoritative literature provides guidance for hedges of

Q68: Which is a true statement regarding the

Q74: What happens when a U.S. company sells

Q80: What factors create a foreign exchange gain?

Q81: Coyote Corp. (a U.S. company in Texas)had

Q83: On October 1, 2021, Jarvis Co. sold

Q84: Potter Corp. (a U.S. company in Colorado)had

Q85: Prepare all journal entries in U.S. dollars

Q86: Coyote Corp. (a U.S. company in Texas)had

Q100: How can an export sale result in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents