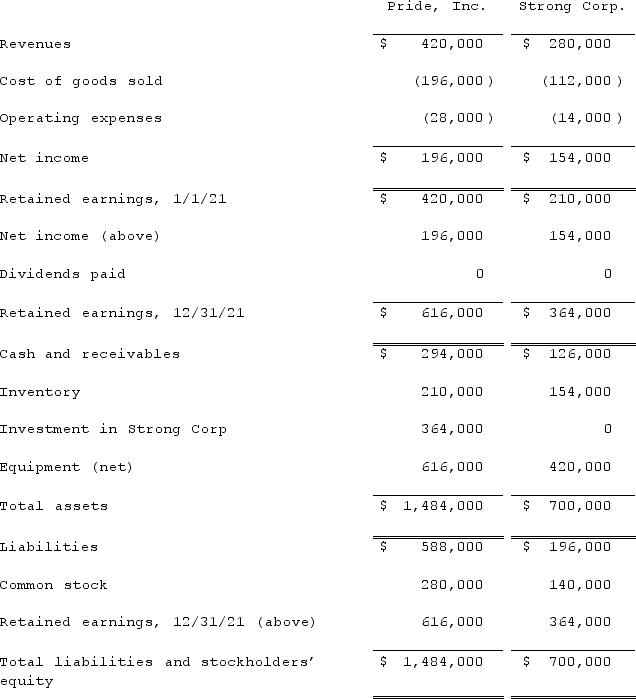

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated revenues at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated revenues at December 31, 2021?

A) $700,000.

B) $644,000.

C) $588,000.

D) $560,000.

E) $840,000.

Correct Answer:

Verified

Q23: Strickland Company sells inventory to its parent,

Q30: Strickland Company sells inventory to its parent,

Q31: Strickland Company sells inventory to its parent,

Q35: On January 1, 2021, Pride, Inc. acquired

Q36: On January 1, 2021, Pride, Inc. acquired

Q41: Anderson Company, a 90% owned subsidiary of

Q43: Anderson Company, a 90% owned subsidiary of

Q44: Anderson Company, a 90% owned subsidiary of

Q49: An intra-entity transfer took place whereby the

Q53: Patti Company owns 80% of the common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents