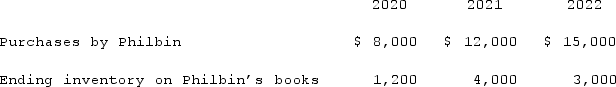

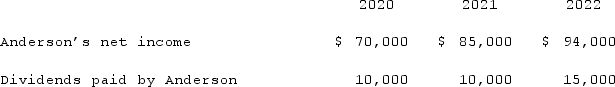

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2020 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2020 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?

A) $0.

B) $1,600.

C) $300.

D) $240.

E) $270.

Correct Answer:

Verified

Q43: Anderson Company, a 90% owned subsidiary of

Q43: Which of the following statements is true

Q44: Anderson Company, a 90% owned subsidiary of

Q47: Anderson Company, a 90% owned subsidiary of

Q48: An intra-entity transfer of a depreciable asset

Q49: Anderson Company, a 90% owned subsidiary of

Q50: Patti Company owns 80% of the common

Q51: Parent sold land to its subsidiary resulting

Q52: Anderson Company, a 90% owned subsidiary of

Q53: Patti Company owns 80% of the common

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents