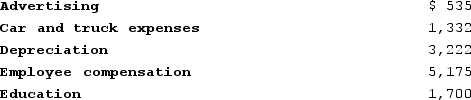

Smith operates a roof repair business. This year, Smith's business generated cash receipts of $32,660, and Smith made the following expenditures associated with his business:

The education expense was for a two-week, nighttime course in business management. Smith believes the expenditure should qualify as an ordinary and necessary business expense. What net income should Smith report from his business? Smith is on the cash method and calendar year.

The education expense was for a two-week, nighttime course in business management. Smith believes the expenditure should qualify as an ordinary and necessary business expense. What net income should Smith report from his business? Smith is on the cash method and calendar year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: Crystal operates a business that provides typing

Q90: Judy is a self-employed musician who performs

Q91: Which of the following is a true

Q92: Jones operates an upscale restaurant and he

Q93: Which of the following is a true

Q95: Bryon operates a consulting business and he

Q96: Which of the following is a true

Q97: Todd operates a business using the cash

Q98: Which of the following is NOT considered

Q99: Todd operates a business using the cash

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents