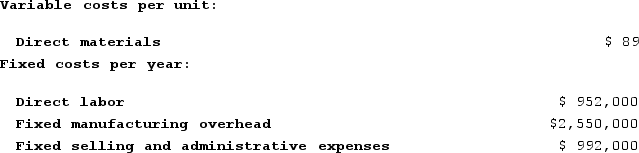

Michelman Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 34,000 units and sold 31,000 units. The company's only product is sold for $254 per unit.The company is considering using either super-variable costing or an absorption costing system that assigns $28 of direct labor cost and $75 of fixed manufacturing overhead to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 34,000 units and sold 31,000 units. The company's only product is sold for $254 per unit.The company is considering using either super-variable costing or an absorption costing system that assigns $28 of direct labor cost and $75 of fixed manufacturing overhead to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

A) Absorption costing net operating income exceeds super-variable costing net operating income by $309,000.

B) Absorption costing net operating income exceeds super-variable costing net operating income by $225,000.

C) Super-variable costing net operating income exceeds absorption costing net operating income by $309,000.

D) Super-variable costing net operating income exceeds absorption costing net operating income by $225,000.

Correct Answer:

Verified

Q286: Neelon Corporation has two divisions: Southern Division

Q287: Paparelli Corporation manufactures and sells one product.

Q288: Super-variable costing is most appropriate where:

A) direct

Q289: Carriveau Corporation has two divisions: Consumer Division

Q290: Grandin Corporation manufactures and sells one product.

Q292: Jemmott Corporation has two divisions: Western Division

Q293: Jemmott Corporation has two divisions: Western Division

Q294: Buckbee Corporation manufactures and sells one product.

Q295: Paparelli Corporation manufactures and sells one product.

Q296: Neelon Corporation has two divisions: Southern Division

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents