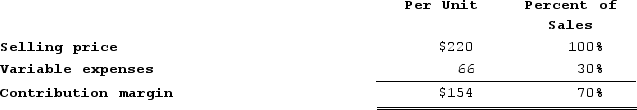

Sannella Corporation produces and sells a single product. Data concerning that product appear below:  Fixed expenses are $991,000 per month. The company is currently selling 8,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept a decrease in their salaries of $74,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 200 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $991,000 per month. The company is currently selling 8,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept a decrease in their salaries of $74,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 200 units. What should be the overall effect on the company's monthly net operating income of this change?

A) increase of $1,246,600

B) increase of $14,600

C) decrease of $133,400

D) increase of $71,800

Correct Answer:

Verified

Q96: Tropp Corporation sells a product for $10

Q97: Awtis Corporation has a margin of safety

Q98: Chovanec Corporation produces and sells a single

Q99: Kuzio Corporation produces and sells a single

Q100: Hopi Corporation expects the following operating results

Q102: How much will a company's net operating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents