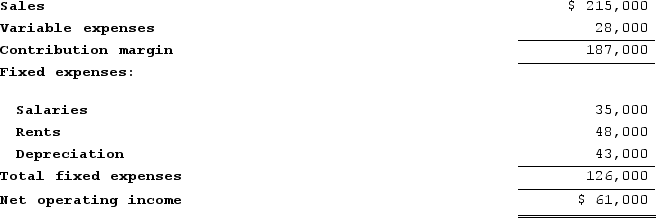

Olinick Corporation is considering a project that would require an investment of $329,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows (Ignore income taxes.) :  The scrap value of the project's assets at the end of the project would be $25,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to: (Round your answer to 1 decimal place.)

The scrap value of the project's assets at the end of the project would be $25,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to: (Round your answer to 1 decimal place.)

A) 3.2 years

B) 5.4 years

C) 4.3 years

D) 2.8 years

Correct Answer:

Verified

Q48: The internal rate of return method assumes

Q49: The Zingstad Corporation is considering an investment

Q50: Rennin Dairy Corporation is considering a plant

Q51: Buy-Rite Pharmacy has purchased a small auto

Q52: If the net present value of a

Q54: Jarvey Corporation is studying a project that

Q55: The management of Lanzilotta Corporation is considering

Q56: Olinick Corporation is considering a project that

Q57: A company has unlimited funds to invest

Q58: A company with $500,000 in operating assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents