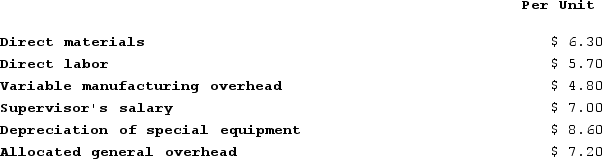

Part S51 is used in one of Haberkorn Corporation's products. The company makes 12,000 units of this part each year. The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce this part and sell it to the company for $37.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $17,000 of these allocated general overhead costs would be avoided.The annual financial advantage (disadvantage) for the company as a result of buying the part from the outside supplier would be:

An outside supplier has offered to produce this part and sell it to the company for $37.70 each. If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided. The special equipment used to make the part was purchased many years ago and has no salvage value or other use. The allocated general overhead represents fixed costs of the entire company. If the outside supplier's offer were accepted, only $17,000 of these allocated general overhead costs would be avoided.The annual financial advantage (disadvantage) for the company as a result of buying the part from the outside supplier would be:

A) ($5,800)

B) ($22,800)

C) ($149,800)

D) ($39,800)

Correct Answer:

Verified

Q93: Wallen Corporation is considering eliminating a department

Q94: Kahn Corporation (a multi-product company) produces and

Q95: Sharp Corporation produces 8,000 parts each year,

Q96: The management of Furrow Corporation is considering

Q97: A study has been conducted to determine

Q99: The management of Furrow Corporation is considering

Q100: The Cook Corporation has two divisions--East and

Q101: The SP Corporation makes 40,000 motors to

Q102: Gordon Corporation produces 1,000 units of a

Q103: Gallerani Corporation has received a request for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents