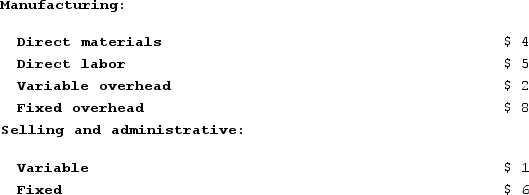

The following are Silver Corporation's unit costs of making and selling an item at a volume of 8,000 units per month (which represents the company's capacity) :  Present sales amount to 7,000 units per month. An order has been received from a customer in a foreign market for 1,000 units. The order would not affect regular sales. Total fixed costs, both manufacturing and selling and administrative, would not be affected by this order. The variable selling and administrative costs would have to be incurred for this special order as well as all other sales. Assume that direct labor is a variable cost.What is the financial advantage (disadvantage) for the company from this special order if it prices the 1,000 units at $20 per unit?

Present sales amount to 7,000 units per month. An order has been received from a customer in a foreign market for 1,000 units. The order would not affect regular sales. Total fixed costs, both manufacturing and selling and administrative, would not be affected by this order. The variable selling and administrative costs would have to be incurred for this special order as well as all other sales. Assume that direct labor is a variable cost.What is the financial advantage (disadvantage) for the company from this special order if it prices the 1,000 units at $20 per unit?

A) $1,000

B) $9,000

C) ($6,000)

D) $8,000

Correct Answer:

Verified

Q174: Penagos Corporation is presently making part Z43

Q175: Balser Corporation manufactures and sells a number

Q176: Ahrends Corporation makes 70,000 units per year

Q177: The following are Silver Corporation's unit costs

Q178: Balser Corporation manufactures and sells a number

Q180: The following are Silver Corporation's unit costs

Q181: Younes Incorporated manufactures industrial components. One of

Q182: The Wester Corporation produces three products with

Q183: Elfalan Corporation produces a single product. The

Q184: Elfalan Corporation produces a single product. The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents