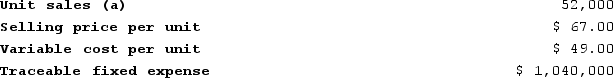

Chruch Corporation manufactures numerous products, one of which is called Tau-42. The company has provided the following data about this product:  Management is considering decreasing the price of Tau-42 by 8%, from $67.00 to $61.64. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 52,000 units to 57,200 units. Assuming that the total traceable fixed expense does not change, what net operating income (loss) will product Tau-42 earn at a price of $61.64 if this sales forecast is correct?

Management is considering decreasing the price of Tau-42 by 8%, from $67.00 to $61.64. The company's marketing managers estimate that this price reduction would increase unit sales by 10%, from 52,000 units to 57,200 units. Assuming that the total traceable fixed expense does not change, what net operating income (loss) will product Tau-42 earn at a price of $61.64 if this sales forecast is correct?

A) $(316,992)

B) $657,280

C) $(65,728)

D) $723,008

Correct Answer:

Verified

Q296: The management of Musselman Corporation would like

Q297: Hanisch Corporation would like to use target

Q298: Mercer Corporation estimates that an investment of

Q299: Ecob Corporation uses the absorption costing approach

Q300: Weitman Corporation manufactures numerous products, one of

Q302: Pascal Corporation manufactures numerous products, one of

Q303: Twisdale Corporation manufactures numerous products, one of

Q304: Kinsley Corporation manufactures numerous products, one of

Q305: Herrell Corporation manufactures numerous products, one of

Q306: Chruch Corporation manufactures numerous products, one of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents