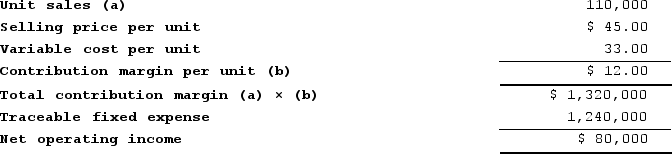

Yashinski Corporation manufactures numerous products, one of which is called Alpha46. The company has provided the following data about this product:

Required:

Required:

a. Management is considering increasing the price of Alpha46 by 15%, from $45.00 to $51.75. The company's marketing managers estimate that this price hike would decrease unit sales by 25%, from 110,000 units to 82,500 units. Assuming that the total traceable fixed expense does not change, what net operating income will Alpha46 earn at a price of $51.75 if this sales forecast is correct?

b. Assuming that the total traceable fixed expense does not change, how many units of Alpha46 would Yashinski need to sell at a price of $51.75 to earn the same net operating income that it currently earns at a price of $45.00? (Round your answer up to the nearest whole number.)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q398: Quamma Corporation makes a product that has

Q399: Swagger Corporation purchases potatoes from farmers. The

Q400: Prosner Corporation manufactures three products from a

Q401: Ritner Corporation manufactures a product that has

Q402: Gildersleeve Corporation manufactures a product that has

Q404: Ohanlon Corporation manufactures numerous products, one of

Q405: Lodholz Corporation would like to use target

Q406: Quamma Corporation makes a product that has

Q407: The management of Landstrom Corporation would like

Q408: Ohanlon Corporation manufactures numerous products, one of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents